How To Calculate Labour Costs As A Heating & Plumbing Business

![[Featured Image] Labour costs](https://gasengineersoftware.co.uk/wp-content/uploads/2024/09/Featured-Image-Labour-costs.png)

Good pricing is crucial to the success of any trades business, and it’s impossible to consistently price jobs well without an idea of your labour costs.

For any job, labour costs make up a good portion of your pricing. An accurate understanding of what your time is worth allows you to price jobs so that you’re making a good profit each and every time.

But working out labour costs isn’t as simple as tallying up your salary and that of any employees for an hourly rate. Labour costs need to cover many other expenses in your business relating to your employees.

In this blog, we’ll answer common questions around labour cost including:

What is labour cost?

Labour costs refer to the total expenses associated with employing staff (including yourself). For many trades businesses, labour costs make up a big chunk of expenses. They include not only payroll but any other financial cost related to your company’s employees such as National Insurance contributions, pension contributions, overtime pay, and so on. However, labour costs should also factor in variable or one-off expenses like training and certification.

Managing these costs effectively is essential for the sustainability and growth of trades businesses in the competitive UK market. The amount you charge for your labour should be more than enough to cover these expenses, as there needs to be some left over as profit for the business.

How to calculate your labour cost

The hardest part about calculating your labour cost is having all the numbers to hand – the actual calculation is quite simple.

Step 1: Add up all employee salaries

The first step is to calculate how much you pay your employees. If you work as a sole trader, this would be simply the salary you pay yourself.

The problem with this figure is that employees cost more than the salary that they receive. This is why the next step is to add all the extra.

Step 2: Factor in any additional costs

Since labour costs include any expense related to an employee, you’ll need to take into account everything else related to your employees. These can either be fixed costs (those that are the same month on month, regardless of how much work you do) and variable costs (those that vary based on the amount of work).

Examples include:

- Software subscriptions

- Overtime

- Bonuses

- National Insurance contributions

- Private pension contributions

- Fuel & other transport expenses

- Licences

- Training & certification courses

Step 3: Add them together

For example:

A heating & plumbing business owner that hires two employees might have a labour cost of the following:

- Total salaries: £120,000 p.a.

- Additional costs: £22,400 p.a.

- Total labour cost: £142,400 p.a.

What is a labour cost percentage?

Your labour cost percentage is the proportion of labour costs in relation to the total revenue your business makes.

The formula to calculate your labour cost percentage is:

Labour costs / total revenue (in the same time period)

For most trades businesses, a labour cost between 20-40% is ideal. This figure is important for tracking the health of your business and will help you determine whether you’re spending too much on labour or something else.

Continuing the example from above, if the total revenue was £628,000 p.a. Their labour cost percentage would be

142,400 / 628,000 = 22.7%

Do you charge VAT on labour?

Any tradesperson in the UK will be familiar with VAT when it comes to materials. It’s a 20% tax added onto almost all goods, products, and services.

Since VAT is charged for the service and invoice as a whole, this means that yes – for VAT-registered businesses, VAT is charged on labour costs.

* Note that most trades businesses choose to incorporate VAT into their labour costs instead of itemising it out for the customer to help avoid confusion.

Adding VAT to your invoice using Gas Engineer Software is quick and easy. Simply input your VAT number to your account settings and the rest is done for you. Sign up for a free trial today.

Non-VAT-registered businesses may have a competitive advantage in this regard, but there are several benefits to getting VAT-registered before hitting the current £90,000 limit including not having to raise your prices later and avoiding any potential fines.

There are a few exceptions in which VAT should not be charged on labour (or is charged at a reduced rate, meaning you can offer more competitive prices to customers. These cases include:

- Work done on new build houses

- Solar panel installations

- Heat pump installations

- Insulation work

You can read more about VAT exemptions and reductions here.

How are labour costs used in job pricing?

There are many different ways to price a business. As some examples:

- You could do a competitor-based pricing approach where you look at similar trades businesses in your area and price yourself on the lower or higher end (depending on what kind of customers you want to attract).

- You could do markup pricing where you calculate the cost of materials and add a percentage markup (which covers your labour costs)

- You could use your labour costs to put together an hourly rate

- For some jobs, a flat-rate may be the best approach.

Depending on what type of trades business you run, different pricing strategies can be more appropriate. However, in all of these strategies, knowing your labour cost and labour cost percentage is crucial. If you are not able to earn enough to cover these costs and make a profit, something will need to change in your business.

For most trades businesses, calculating a properly-costed hourly rate is the simplest and most effective way to price.

- This figure can be used for larger jobs by simply estimating the total time it would take to complete and multiplying them together.

- Likewise, for smaller jobs a fixed cost can be calculated using this hourly rate.

How do you calculate your hourly rate?

First, there’s a few things you need to consider. Your hourly rate needs to factor in every cost in your business and be a rate you can charge to earn the profit you desire. You’ll need to know:

- Labour costs (which we know from earlier)

- All business overheads

Once you have a figure for your total business costs, you can add on a desired profit, and divide it by the number of billable hours in the year. For this, you’ll need to know:

- Holiday and other paid time off

- Sick days

- Non-billable hours (admin work, driving, etc)

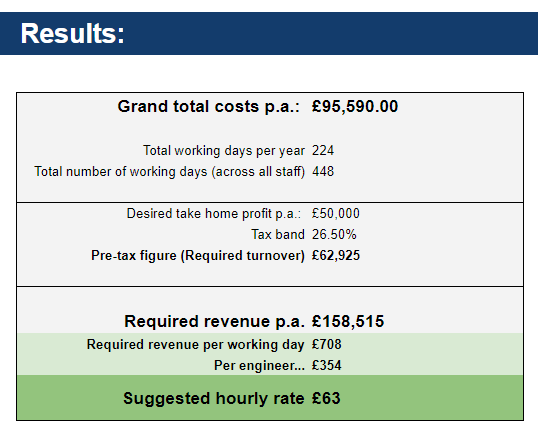

We’ve put together a full guide for calculating your hourly rate here. An alternative method is to use our pricing calculator to work all this out. It’ll look something like this:

Should you show your labour cost on your quotes?

Whether you’re using a labour cost figure or a fully costed hourly rate, not all trades businesses prefer to add this onto their quote. Some customers can take issue with labour rates – particularly if the job was a quick fix as they don’t think about the years of experience behind the work.

Ultimately, there is no right or wrong answer. It depends on personal preference and the type of job being quoted for. It may make more sense to add labour rates onto a larger job that takes a few days or weeks to complete, while a small <1 hour job might skip it.

Alternatives include flat or fixed prices or adding a markup on materials.

Next steps:

If you’ve been thinking about implementing software into your workflow to save time, here’s what you can do next:

- Visit our resources centre where you'll find more articles like this one and our free gas rate calculator.

- Start a free trial to see exactly how our software works for your business.

- Watch our video demo to get an idea of how our software works. You can also book a 1-on-1 session with our customer success team for a more personalised experience.

- Know an engineer who's still using paper? Help them and us out by sending our software their way!