How Gas Engineers Can Use Open Banking to Get Paid Faster

![[Featured Image] Open banking-min Open banking offers a new and](https://gasengineersoftware.co.uk/wp-content/uploads/2023/09/Featured-Image-Open-banking-min.png)

There isn’t a seasoned gas engineer who hasn’t had to deal with the nightmare of late payments.

Rising energy costs, inflation, and the seasonal fluctuations of a heating and plumbing company are enough to deal with – let alone late payers. For smaller companies that rely on a consistent monthly cash flow, they’re a very real burden.

For a sense of scale, it’s been reported that SMEs in the UK are owed £32.1 billion in late payments.

Because of this, many don’t have enough cash in the bank to hire an additional engineer or try a new solution. Others (up to 25%) say they haven’t even been able to take a holiday in the past couple years because of money they’re owed, but don’t yet have.

Big businesses might have enough money that late payments don’t affect their day to day operation. But for the rest, it’s about finding ways to minimise late payments, reduce the amount of time spent chasing customers up, and to stop being a slave to paperwork.

Open banking offers a new and modern payment solution that offers gas engineers a way to get paid quickly, easily, and without costly fees. In this article, we’re going to explain what open banking is, what benefits it offers, and how it can be easily integrated into your workflow.

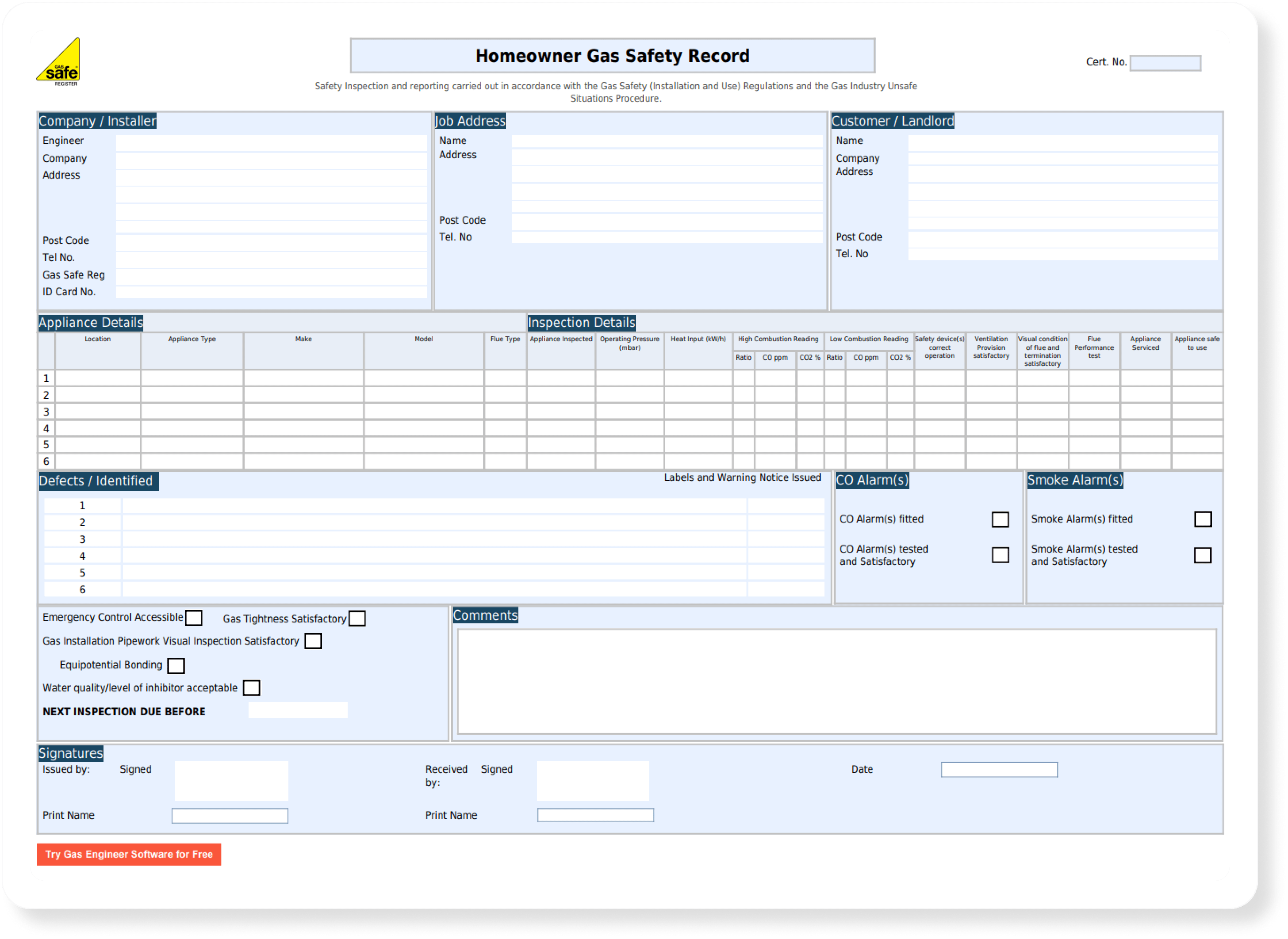

First, let’s take a step back and analyse the industry’s three most popular payment methods.

Yesterday’s three popular payment methods

- Bank transfers

- Card

- Cash or cheque

Bank transfers

Card payments

Cash & cheque

Lastly, there’s good old cash or cheque. In theory, you get paid on the spot and there are no fees – but most people don’t have enough cash (let alone a cheque book) lying around. And after you’ve been paid, depositing cash and cheques is just another time-consuming admin task.

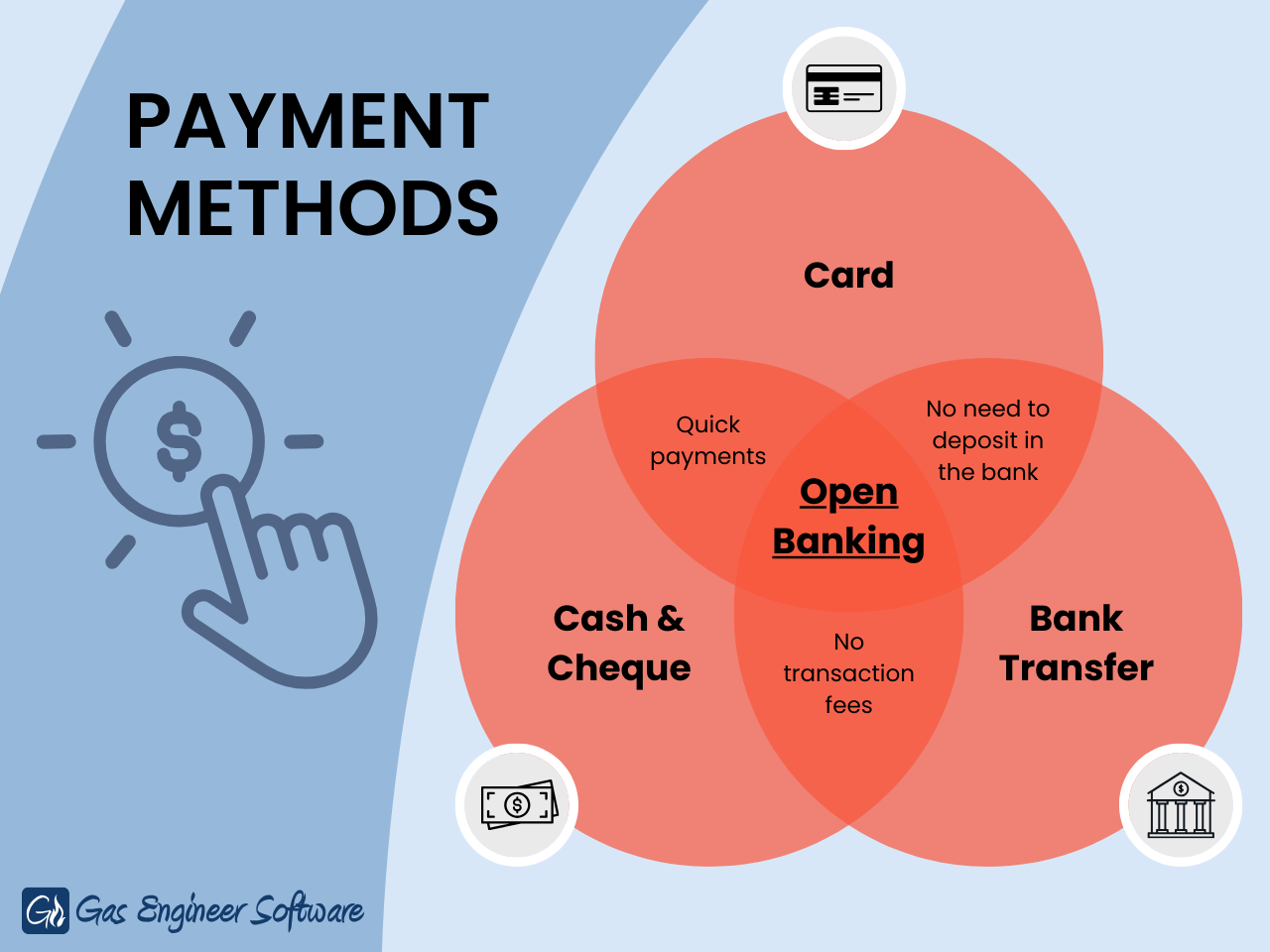

Here’s a visual summary of the different payment methods:

With one of the three classic payment methods, you’re forced to pick just 2 – never all 3 – of the benefits.

None of these solutions have provided small businesses with a truly effective way of getting paid on time. With a reported 58% of SMEs waiting on payments and with a limited cash flow, the majority of small businesses simply aren’t reaching their full potential.

That’s all before mentioning the huge burden of worry and stress caused by late payments, associated mental health detriments, and loss of potential further income. Read more on this topic in our article featured in HVP Magazine’s Nov/Dec 2023 issue.

%

of businesses are waiting on late payments

Introducing open banking

Open banking sounds complex, but can actually be summarised quite easily.

In short, open banking is where regulated third-party companies are able to improve the functionality, convenience, and security of services already provided by high street bank names you’re well familiar with.

Most importantly, it’s designed to be a solution everyone can benefit from – not just those in the tech or finance space. This means that it does not matter how tech-savvy you and your customers are.

What are the benefits of open banking?

Put simply, open banking means you no longer have to settle for a sub-par payment solution.

As a gas engineer, shifting towards an open banking solution like Crezco to receive your payments is as easy as providing your customers with a link or QR code. They can scan on the spot and pay you direct-to-bank from their phones quickly, easily, and without costly fees.

And remember – convenience is king. No customer wants to fiddle around with online banking, writing checks, going to an ATM – and so on. The simple payment methods open banking solutions offer are far easier for your customer, which is something they will appreciate. They’re also far more efficient for you, as you won’t be making any more trips to the bank to deposit cash or cheques.

In other words, you get all the benefits of the other payment methods without any of the downsides. Its almost too good to be true.

Crezco: the leading solution

Crezco is one of the leaders in the open banking space, offering seamless payment solutions for a wide range of SMEs – including gas engineers.

They opened shop in 2020 and have since collaborated with over 500 UK and EU banks to offer instant payments to over 6000 companies.

What sets Crezco apart from the competition is their clear target market: small and medium-sized businesses. Because of this, Crezco is perfect for many of the UK’s heating and plumbing companies who need a cost-effective solution that understands their needs.

Crezco integration with Gas Engineer Software

As part of a shared mission to bring modern conveniences and solutions to the heating and plumbing industry, Crezco and Gas Engineer Software have joined forces.

Gas Engineer Software users now have the option to use Crezco integrated with our app. Each payment has a small 30p fee that won’t increase no matter the size of your job.

Gas Engineer Software users can read this quick setup guide to connect Crezco with their account.

The goal behind this collaboration is to help gas engineers free themselves from the stress and worry of an unreliable cash flow.

Especially when combined with all of the other Gas Engineer Software features, Crezco offers a comprehensive payment system to reduce the number of late payers and streamline your business.

All of your old payment methods are still available, but we guarantee you’ll find Crezco a welcome addition to both your own and your customers’ lives.

Get the benefits of open banking together with software primed to grow your business. Book a demo with Gas Engineer Software to see how it works in practice.

A quick recap

Open banking has made a name for itself these past few years. But, while many gas engineers have heard of the term, few know how it can benefit them and their companies in the real world.

Put short, open banking offers a new way of receiving and making payments that is far more efficient than other traditional options. There are no fees, payment is near-instant, and it’s far more convenient – both for customers and engineers.

Crucially, this is a much cleaner and streamlined way of getting your invoices paid. Without the burden of late payments tying you down, you’ll be one step closer to running your business how you always wanted to.

Need help getting set up?

If you already use Gas Engineer Software, getting set up is only a few clicks away. Read this quick guide or get in touch with us for any questions.

For those new to Gas Engineer Software, we highly recommend starting a free trial of our software or booking a demo. Both will show you how Crezco works in the real world and the benefits it can bring.

Next steps:

If you’ve been thinking about implementing software into your workflow to save time, here’s what you can do next:

- Visit our resources centre where you'll find more articles like this one and our free gas rate calculator.

- Start a free trial to see exactly how our software works for your business.

- Watch our video demo to get an idea of how our software works. You can also book a 1-on-1 session with our customer success team for a more personalised experience.

- Know an engineer who's still using paper? Help them and us out by sending our software their way!