A Simple Tax Guide For Heating & Plumbing Companies [Updated 2025]

Have you ever been surprised or caught off guard by a tax bill? Or maybe just dread the looming task of sorting through your records and submitting your return?

You wouldn’t be alone.

Tax is easy when you’re an employee, but business owners get it rough with all the record-keeping, tax returns, and responsibility of it all.

Getting it right from the start truly does help. Here’s a simple and actionable tax guide for heating & plumbing business owners who want to avoid the last-minute tax panic.

When to start doing your taxes

Ideally, you should start doing your taxes as soon as the new year starts on April 6. This doesn’t mean filling out any forms, but rather keeping your paperwork in order and all incomings and outgoings recorded.

Doing this helps keep the headaches and painstaking accounts issues to a bare minimum when you do come to fill out your return.

Start organising all your expenses and income from day 1

Invoices, bank statements, receipts, and everything else should all be kept and organised.

Doing this from the very first day of the tax year means you don’t have to spend hours looking for something later down the line – or worse, as you’re filling out the tax return.

If something does go wrong and HMRC does an investigation, you’ll be expected to produce records dating back up to 6 years. Any missing, disorganised, or lost records and you can just imagine how stressful that would be. You could also run into fines for this.

It’s good practice to spend a little time doing this on the regular. Small chunks of work are much more manageable than having to clear several days as the deadline looms.

Why is this important?

The short answer is that tax can be stressful. Other than that:

- Knowing your tax bill well in advance helps you plan and make sure you’ve got funds set aside to pay it.

- Fines for late submissions rack up into the hundreds of £.

- Staying organised from day 1 saves countless hours in the long run (even if it takes a little longer at the start).

- With good records, you can easily see what’s deductible from your tax bill. This can mean saving a pretty penny when everything’s calculated.

We were speaking to one of our users recently (Dean Jones from Jones the Gas) who told us about his first experience with tax:

TAX TIP

Use software to keep your accounts organised

HMRC accepts both paper and digital records, so we strongly recommend going down the digital route. It’s a much easier way to keep track of hundreds – if not thousands – of records without filing cabinets taking up space, time, and energy.

Accounting software like Xero, Quickbooks, and Sage are ideal for this, but why not go one step further?

With Gas Engineer Software, you can integrate your day-to-day work with these accounting packages. All your invoices and customers will automatically sync across, keeping everything organised and up-to-date.

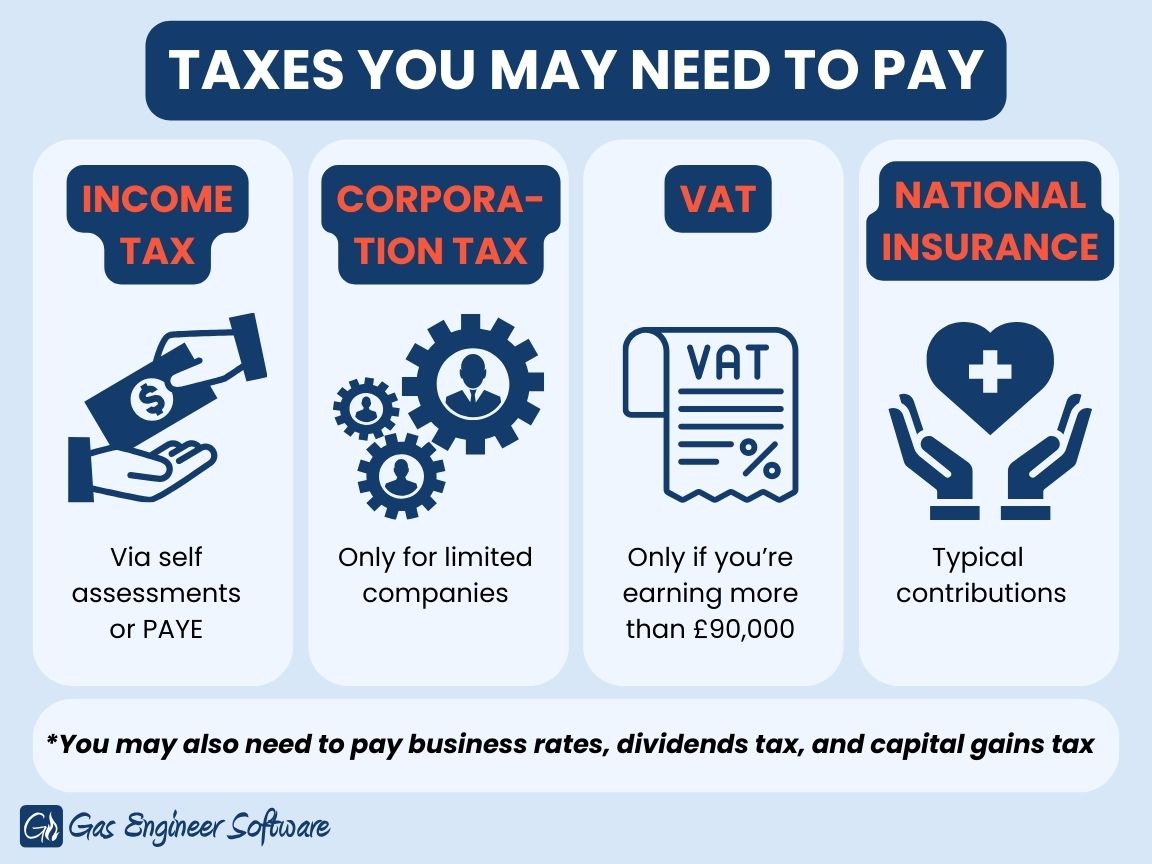

The different types of tax you might need to pay

Depending on the type of heating & plumbing business you run, you might need to pay a few different types of taxes. Here’s a brief breakdown:

Income tax

Corporation tax

Limited companies will need to pay corporation tax. You’ll be taxed on any profit your company makes from day-to-day work, investments, and sold assets. Find out more about corporation tax here.

National insurance

Just like you’ll pay national insurance as an employee, you’re expected to pay National Insurance contributions (so long as you’re hitting the minimum earnings. More info on that here).

VAT

Most sole traders won’t need to bother with Value Added Tax (VAT). However, if you’re earning more than £90,000 as of 1 April 2024, you’ll need to register your business.

In addition to these, you may also have to pay business rates (if you’re using an office space), dividends tax, or capital gains tax.

TAX TIP

Don’t delay VAT registration

If you aren’t already VAT registered, it could be a good idea to get it done. Currently, the VAT limit in the UK sits at £90,000.

However, if you wait until your turnover reaches this figure, you’re going to have to explain a sudden price increase to your customers. To break even, you’ll have to start charging 20% more.

There’s also the fact that your customers are not going to be able to claim the VAT back on purchases like new boilers, and being VAT registered builds customer confidence in your brand.

The difference between balancing payments & payments on account

Balancing payments are the final payment you will need to make to settle your tax bill after accounting for any payments you’ve already made. This typically occurs when:

- You’ve made payments on account (advance payments) but they weren’t enough to cover your actual tax liability

- You’ve had tax deducted at source (like PAYE) but it wasn’t sufficient to cover all your tax obligations.

- You’ve received income that wasn’t taxed at source

Payments on account are payments made in advance for the tax year ahead, based on the previous tax year. Here’s how they work:

- Payments are made twice a year towards your next Self Assessment tax bill.

- Each payment is 50% of your previous year’s tax bill

- First payment: January 31st (along with any balancing payment for the previous tax year)

- Second payment: July 31st

Since a new business has no previous tax year to calculate payments on account, their first bill equals 12 month’s worth of balancing payment & 6 month’s worth of payments on account.

What are the current tax bands?

For self assessment:

| Band | Taxable income | Tax rate |

| Personal Allowance | Up to £12,570 | 0% |

| Basic rate | £12,571 to £50,270 | 20% |

| Higher rate | £50,271 to £125,140 | 40% |

| Additional rate | over £125,140 | 45% |

For corporate tax

| Rate | 2024-2025 |

| Small profits rate (less than £50,000) | 19% |

| Main rate (more than £250,000) | 25% |

| Marginal relief (between £50,000 and £250,000) | 25% minus marginal relief, which you can calculate here for your business. |

Save 20% of your turnover for tax

“I was going full steam ahead thinking I was earning loads of money…but at the end of my first year trading, I had a huge tax bill. It was hard, hard work paying that off.”

– Dean Jones, Jones the Gas

If you save 20% of your turnover (not profit) as soon as you make it, you’ll always have enough to cover your tax bill.

In fact, you’ll probably be saving a little too much — which means you can give yourself a nice little bonus at the end of the year.

For more established businesses, this strategy offers complete peace of mind throughout the year. But for new business owners, it’s even more important:

Because of the way the UK tax system is arranged, your first tax bill as a new business is always going to be your worst. This is because you’re essentially paying 18 months worth of tax, rather than 12, as you’re paying for the previous 12 months of balancing payments, plus the next 6 months of payments on account.

Speaking to a professional accountant on our podcast, this is something that most tradespeople experience when they first start out.

TAX TIP

Work out what you can get deducted from your tax bill

Thanks to deductions, your tax bill should always be a bit less than the stated rate for your band.

If you’ve kept good records of your expenses over the past year, working out what you can save money on should be a fairly straightforward task.

Expenses you can claim from your tax

- Landline, mobile, and internet bills

- Materials

- Purchasing & maintenance of equipment (including computers, phones, tablets)

- Tools & work clothing

- Interest on loans

- Stationery & office supplies

- Postage

- Industry magazines / subscriptions

- Advertising costs

- Vehicles & vehicle maintenance costs

- Travel costs (including fuel)

- Accountancy fees

- Payroll

- Insurance

You can also claim for a lot of this if you work from home / use your home as your office.

When to incorporate your business

Incorporating a business offers marginal tax efficiency, and you could end up paying about 1-2% less in taxes.

However, for some trades businesses, the extra admin and paperwork involved simply isn’t worth the hassle.

The real reason to incorporate your trades business is to do with risk management. As a sole trader, all your personal assets are at risk. Should the worst case scenario happen, you get in debt, and can’t pay your bills, you could be taken to court and lose your home. Meanwhile, running a limited company means you are limited by the liability of the amount of shares you hold.

On our podcast, accountant Jed Eatough shared his opinion: “There’s a general rule of thumb I personally advise clients. Once you start turning over more than your house is worth, you want to start incorporating your business”.

Some extra tips to take note of:

1. Open a business bank account

Especially if you’re VAT registered, it’s a great idea to open a second business bank account. We spoke to an admin expert – Michele Ibbs from I’m Your P.A.on one of the episodes of our Podcast – who suggested it be a good idea to take 20% of whatever you earn and set it aside for tax.

This way, you’ll always have enough set aside to pay your tax bill and it won’t feel like as much of a huge dent in your bank.

For sole traders, separating personal and business finances will also help keep things organised and systematic.

2. Submit your tax return well before the deadline

You should aim to submit your tax return at least a couple months ahead of the deadline. Especially in the last month, HMRC helplines are bogged down with calls from businesses and individuals all over the country struggling to fill out their tax forms. It’s not uncommon to have to wait over an hour just to speak to someone on the phone.

Not to mention, rushing things last minute is a recipe for mistakes, stress, and more tax headaches.

3. Consider hiring a qualified accountant to help

The only true way out from the tax stress is to spend a little money and get help from a tax specialist. Depending on your business, this could be the best solution. You’ll save hours that you can reinvest into your business, and the peace of mind is a huge bonus.

In addition to this, tax specialists can even save you money, as they know the rules and exactly what you can and can’t claim for.

How can Gas Engineer Software help with all this?

So much of doing your taxes right comes down to proper record keeping. Gas Engineer Software makes it easy for heating & plumbing businesses across to the UK to manage jobs and keep detailed records. This all happens behind the scenes as they go about their days – so you can focus on running your business not stressing about paperwork and tax.

Learn more about this process here.

Next steps:

If you’ve been thinking about implementing software into your workflow to save time, here’s what you can do next:

- Visit our resources centre where you'll find more articles like this one and our free gas rate calculator.

- Start a free trial to see exactly how our software works for your business.

- Watch our video demo to get an idea of how our software works. You can also book a 1-on-1 session with our customer success team for a more personalised experience.

- Know an engineer who's still using paper? Help them and us out by sending our software their way!