Do You Charge Late Fees? [+ email reminder templates]

![[Featured Image] Late fees Late fees can be a great way to incentivise fast payments](https://gasengineersoftware.co.uk/wp-content/uploads/2023/12/Featured-Image-Late-fees-1.png)

Dealing with late payments is part of being a gas engineer. We recently wrote an article in the HVP magazine about how late payments are hurting your business, and how it’s a very real yet underappreciated problem for tradespeople.

Gas engineers working in a world of digital solutions, software, and smartphones, have got a few different ways to get customers to pay quickly and get the cash flowing through their business. For example, open banking solutions like Crezco offer a unique way to instantly pay via QR code. Without the hassle of cash and cheque, card fees, and painstaking manual bank transfers, your customers are much more likely to pay on the spot after a job is done.

But what about a more old fashioned method? Late fees are nothing new – but are they an effective way of getting customers to pay on time?

Read on for more details about late fees such as:

Why is it important to get customers to pay on time?

Looking at the long-term, late payments don’t seem like such an issue. The money is being paid at some point, so no big deal – right?

Not entirely. We had a look at the data from our software and discovered that only about 46% of our monthly 80,000 invoices are paid in full after a normal 2-week payment window. Late payments are, in fact, the cause of a few very real problems.

Firstly, without a reliable and predictable flow of cash coming into your business, it’s hard to plan financially. Any new tools, hires, or business investments you wanted to make might have to be postponed. On top of this, a quarter of tradespeople have reported not being able to take a holiday in the past 2 years because of money tied up in unpaid invoices.

Then, you’ve got to consider all the extra time spent chasing up customers to pay their invoices. Not only is this work tedious and mundane, but it racks up in the long-term and seriously detracts from your real work.

Quick tip: Setting a shorter payment window like 7-14 days can incentivise faster payments.

The pros and cons of late fees

Not everyone uses late fees to encourage fast payments, but they are used to great effect by some. Here are some of the pros and cons:

Pros

- Late fees encourage timely payments. No customer wants to have to pay extra just because they paid late. Many will be incentivised to simply get the payment out of the way as soon as possible.

- You get extra compensation for late payments. If someone does pay late, at least you’re earning a little extra from the delay.

- It makes your business look more professional. As long as the late payment policies are fair and reasonable, they can make your business look more mature and financially aware

Cons

- Puts a strain on some customer relationships. Some customers resent having to pay late fees and might choose not to work with you in the future. It could be a good idea to waive late fees under special circumstances to preserve relationships with some customers that you know are usually prompt with payments or a good source of work.

- Administrative work involved. Charging late fees means another step in your admin work to handle (unless you’ve got software to help).

Is it legal to charge late fees?

It is completely legal in the UK to charge late fees on your invoice.

For business to customer transactions (i.e. any domestic work you do), there are no specific guidelines suggesting how much or how soon your late fees should kick in. However, as long as your late fees are reasonable (in terms of both pricing and time frame), you are well within your rights.

For any commercial work you do, there are some specific regulations. You are allowed to charge both interest and debt recovery costs on late commercial payments. HMRC offers more information about the legality of late commercial payments here.

How much can I charge for late fees?

- Flat rates

For domestic work where invoices are typically only a few hundred pounds for most jobs, flat rates can be the best choice. You can choose to set your own flat rate of maybe 10-30 pounds, depending on what you deem worthwhile and fair to your customers.

For commercial work, flat rates are dictated by HMRC:

| Amount of debt | What you can charge |

| Up to £999.99 | £40 |

| £1,000 to £9,999.99 | £70 |

| £10,000 or more | £100 |

- Interest rates

Interest rates are another option. They are a slightly more complicated system but work fairly for invoices of all sizes.

Statutory interest in the UK sits at 8% plus the Bank of England base rate for business to business transactions. This interest is calculated as an annual figure, and can then be divided to get a daily rate.

If you mainly do domestic work with smaller invoices, we recommend ignoring the complexities of interest-based late payments.

Late fee best practises:

- Lay out your terms and conditions clearly on your invoice. Your customers need to know you have a late payment fee, if you decide to do so.

- Make at least one effort to contact your customer to remind them of the payment before any late payment fees kick in. This will help preserve good will and your customer relationships.

- Your late fees should be high enough to work as a deterrent, but not so high they’re unfair.

- Find a time window that is both fair and impactful in terms of reducing the number of late payments.

- Be ready to waive late payment fees whenever you feel it fair to do so. Late payment fees shouldn’t be about earning a bit of extra cash for your business anyway. Rather, they’re about encouraging on-time payments.

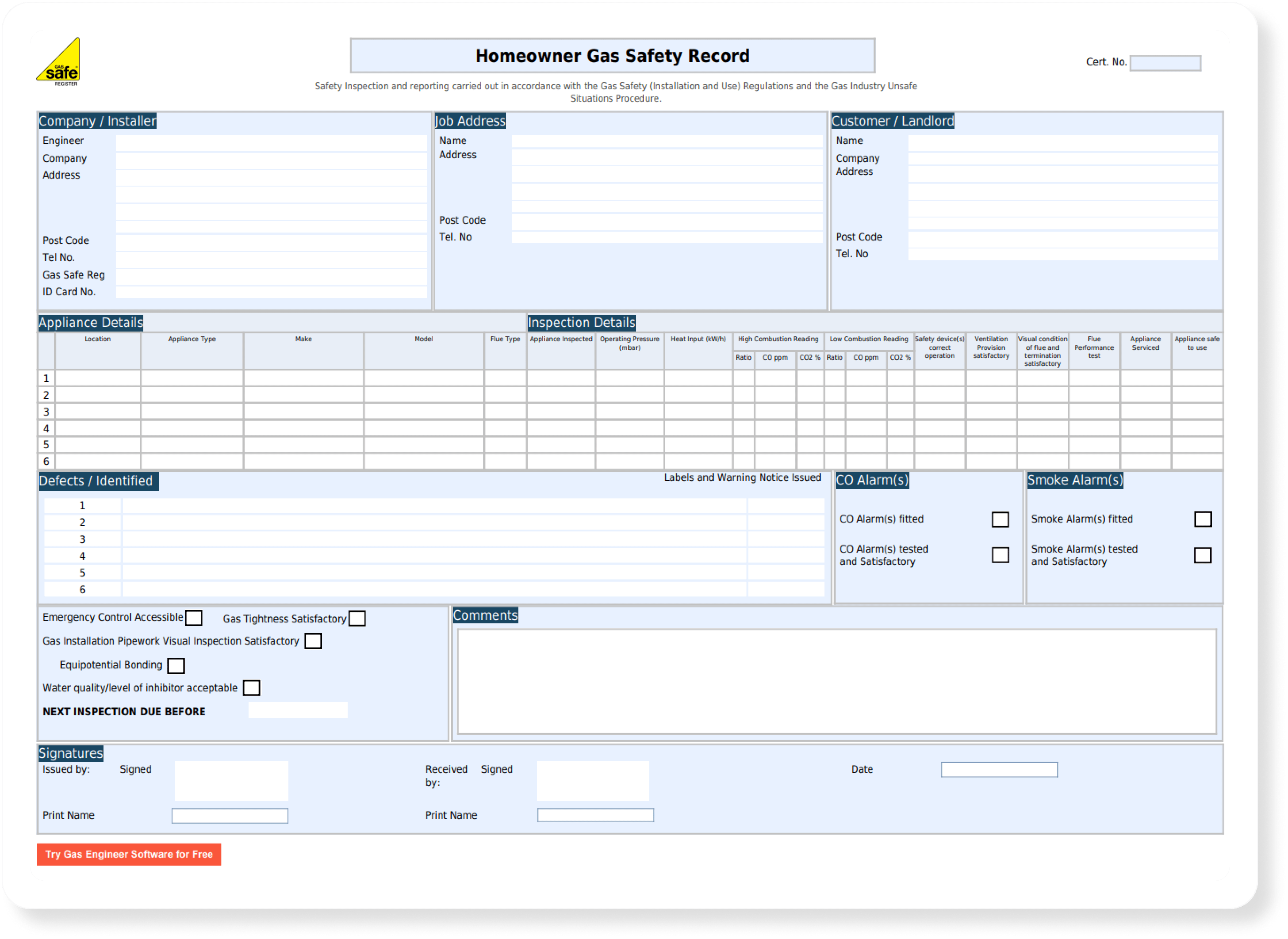

Adding late fees to invoices

Make sure this policy:

- Is clearly legible

- Explains how much you will charge, and how charges are calculated

- Details when the late fee kicks in

- Includes information about payment reminders

- Lists exceptions (if any)

Late fee email reminder templates

Pre-late fee email reminder

Hi [customer name],

I hope you are well.

This is just a quick email to remind you of your outstanding invoice for the job at [customer address].

If you are unable to open the invoice or don’t think you have received it, please let me know.

As a quick note, we do have a late paying policy in place, which is detailed on the invoice. If you need extra time to pay this invoice, please get in touch with us and we’d be happy to work something out.

Thank you once again for choosing to work with [your company name]

All the very best,

[Your name]

[Your contact information]

Post-late fee email reminder

Hi [customer name],

I hope you are well.

This is a reminder for the invoice of the job at [customer address].

Since you have not paid the invoice within our [time frame] payment window, we will be adding an extra late fee to this invoice from today onwards.

[Details of your late payment policy, and how much their new overdue amount will be]

If you were unable to pay this invoice due to circumstances outside of your control, please get in touch with us and we will be happy to discuss a solution.

Thank you once again for choosing to work with [your company name]

All the very best,

[Your name]

[Your contact information]

Conclusion

Late fees are certainly a great way to incentivise quick payments. Within the UK, they’re perfectly legal and a common business practice used to great effect.

That being said, whether or not you want to include them with your invoices is up to you. Some tradespeople feel they are able to get customers to pay on time through other methods, and some don’t want to bother with having to enforce them.

Remember that apps like Gas Engineer Software can help ease the administrative burden and make the process of dealing with late fees and late payments a breeze. Including them on your invoice is made quick and easy with customisable, professional invoice templates, while our automated payment reminders completely eliminate the need for late fees for many.

Next steps:

If you’ve been thinking about implementing software into your workflow to save time, here’s what you can do next:

- Visit our resources centre where you'll find more articles like this one and our free gas rate calculator.

- Start a free trial to see exactly how our software works for your business.

- Watch our video demo to get an idea of how our software works. You can also book a 1-on-1 session with our customer success team for a more personalised experience.

- Know an engineer who's still using paper? Help them and us out by sending our software their way!