Are Late Payments Hurting Your Business?

On the surface, late payments don’t seem like too much of an issue. As long as the money ends up in your account eventually, everything’s fine… right?

Unfortunately, it’s not quite so simple. A consistent and predictable monthly cash flow is crucial to the long-term success of your business. Hiring new employees, taking that holiday you had planned, investing in a new van – all of these are expenses that suddenly become tricky if your monthly income takes an unexpected plunge.

This issue is magnified for smaller businesses when a single invoice can make up a sizable chunk of your monthly income. In fact, a recent study by Direct Line shows that 81% of tradespeople are chasing late payments that total an average of £6,210.

In this article, we’ll discuss how big the late payment issue actually is in the world of plumbing & heating, as well as what you can do to ensure you get paid on time and without having to endlessly chase customers.

How big is the late payment issue?

To get a better picture of how late payments are plaguing the plumbing and heating industry, we ran a quick study. In one month, around 80,000 invoices were sent out through Gas Engineer Software. After a standard two-week payment window, only about 54% were paid in full.

The fact that some customers are taking so long to pay is a genuine concern for tradespeople relying on a stable monthly income.

Why are late payments bad for your business?

Late payments are one of the biggest causes of stress and cash flow problems for businesses. According to research from Barclays, up to 25% of business owners say they haven’t been able to take a holiday in the past couple of years because of money tied up in unpaid invoices.

On top of this, chasing late payers adds a significant amount of admin workload to your already busy schedule. Having to contact, keep track of, and check up on unpaid invoices is never going to be an enjoyable or quick task.

And lastly, as we mentioned above, an unstable cash flow can make it difficult to hire new employees and go through with planned investments into your business (such as a new van, set of tools, analysers, and so on).

How can tradespeople get paid faster?

The good news is that there are many strategies you can use to start getting paid faster – and they’ll save a good chunk of your time, too. Here’s a summary of the most impactful:

1. Add clear payment terms to your invoices

This one sounds simple — but if there’s no specified payment date or the customer isn’t sure how to pay, invoices can get put to one side and forgotten about.

The easiest way to do this is by invoicing with software that allows you to automatically add your payment terms on every invoice by default. Learn more about that here.

You could even experiment with arranging a late fee policy, although this is not typically necessary for domestic work.

2. Send payment reminders

Most late payments are not done maliciously. Often, people just forget or are putting off paying the bill. Simple reminders really do work and can be all that’s needed to nudge a customer to pay for an invoice. Remember, if you’ve completed the work, you have every right to chase for payment.

Granted, we know that this is the very thing we’ve been telling you is a waste of time and administrative burden. The trick is to automate the process so it happens in the background without you having to lift a finger.

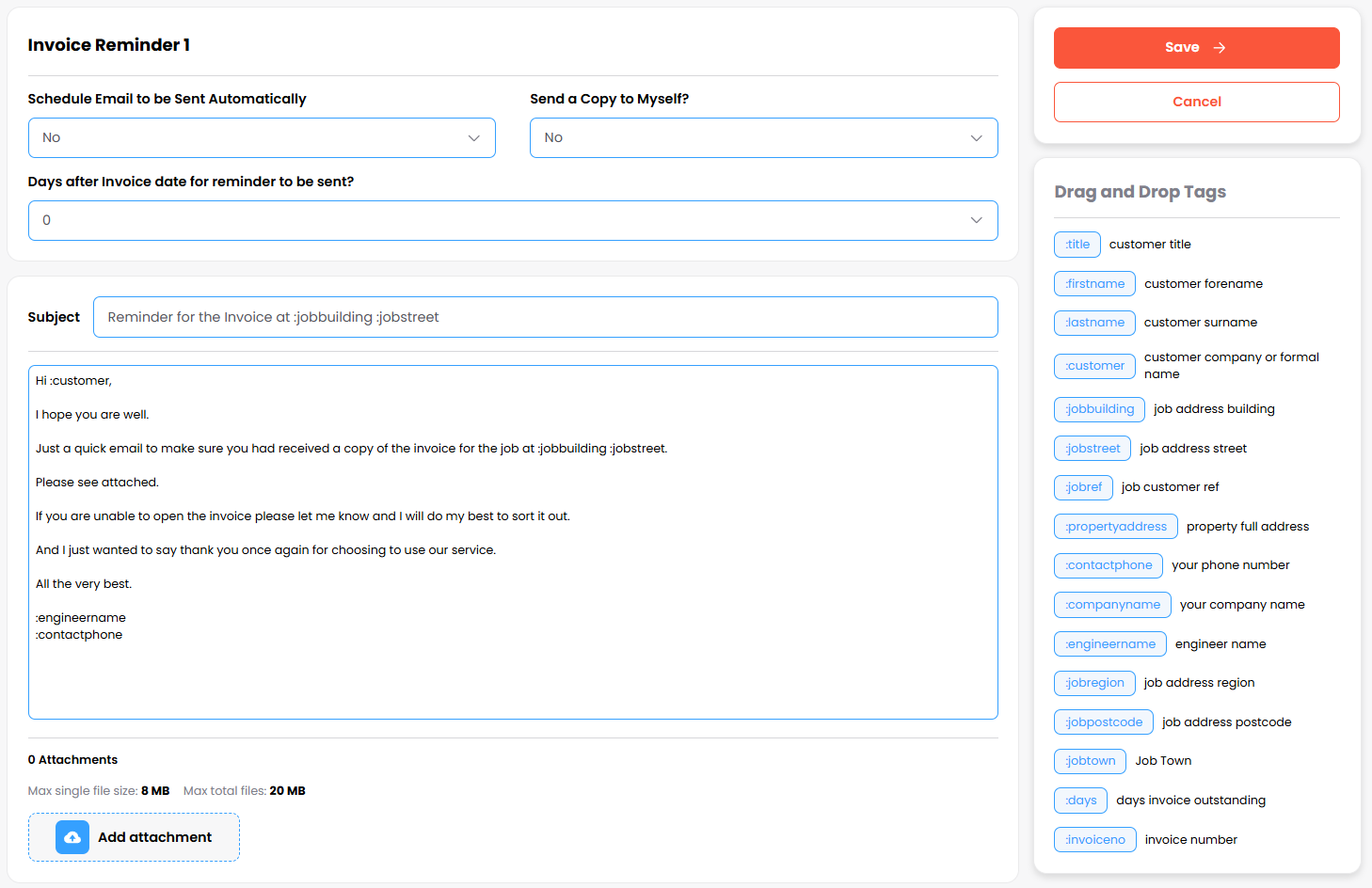

Gas Engineer Software is great for this, and will send out up to 3 sequential invoice reminders that you can personalise and specify when they’re sent. For example, you could set the first reminder to be sent after 10 days, a second after 15, and a third after 20.

Here’s the window where you can set these reminders in the software:

3. Offer multiple payment options

There are several ways you can get paid, each with pros and cons.

There’s of course cash and cheque – the classic payment method that will always be a favourite for some businesses and customers. But these days, more and more customers are leaning towards the convenience of digital payments.

That brings us to card payments: a quick and efficient way to get paid, but with 1-3% fees that can add up in the long run.

Bank transfers then seem like the logical choice: you get paid instantly and there are no fees. But they’re also the most time-consuming option for your customer. They have to find your bank details, log into online banking, and make the transfer. It is rarely done on the spot, and then simply forgotten about.

If you want to get paid fast, the most important thing is to offer multiple options for your customers so they can choose what they prefer.

But you can also experiment with newer and more convenient options that come with open banking systems. For example, invoices generated with Gas Engineer Software can come with a QR code or link customers can scan to pay.

The process is instant, hassle-free, and with much lower fees than card payments.

4. Send invoices on the same day

A very simple but effective way to get paid is to ensure invoices get sent out on the same day.

Some tradespeople will wait until the end of the week before sending out all their invoices in one batch. This might work effectively for your schedule, but it can add days for some customers between having the job finished and receiving an invoice, giving them the impression there’s no rush to pay.

Again, software can help speed up your workflow here. Gas Engineer Software can generate invoices at the click of a button from a previously created quote, meaning you can even send out invoices in the field as soon as the job’s completed.

5. Communicate clearly

Most customers appreciate trades businesses that communicate quickly, politely, and effectively. Together with the quality of your work, these small interactions help build up a good working relationship with a customer. And, the more the customer likes you, the more likely they are to respect your work and pay on time.

This also relates to the above points about payment terms and options. Confusion about how and where to pay can cause late payments in endless ways. Some customers will jump on any excuse not to pay — and the longer it goes unpaid, the harder it is to get paid.

Streamline your workflow with software

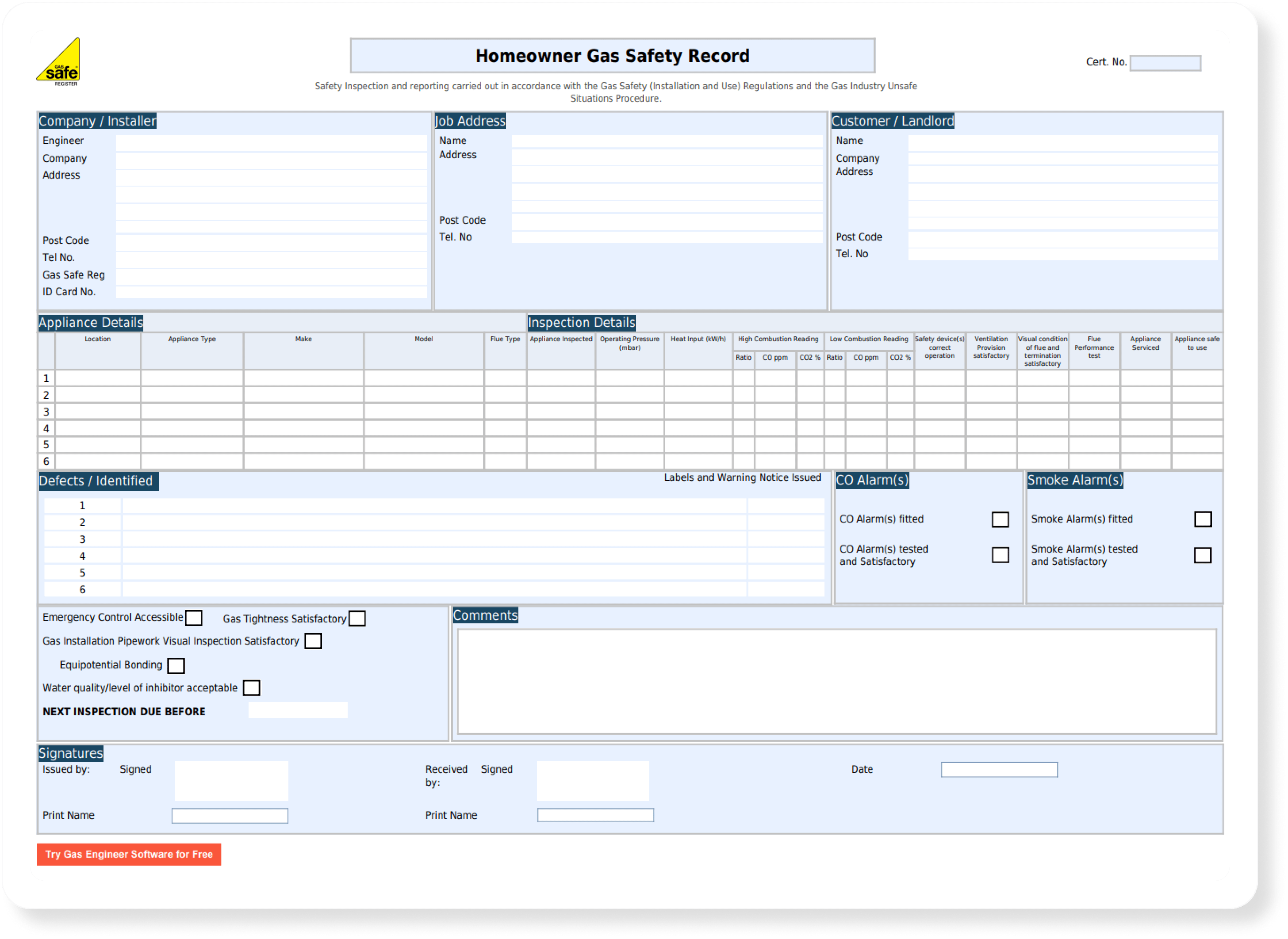

It’s not just about getting paid — you can easily save time with your certificates, scheduling, and lots more on Gas Engineer Software.

Next steps:

If you’ve been thinking about implementing software into your workflow to save time, here’s what you can do next:

- Visit our resources centre where you'll find more articles like this one and our free gas rate calculator.

- Start a free trial to see exactly how our software works for your business.

- Watch our video demo to get an idea of how our software works. You can also book a 1-on-1 session with our customer success team for a more personalised experience.

- Know an engineer who's still using paper? Help them and us out by sending our software their way!